With the development of web3 and my optimism about the prospects of the web3 field, I began to purchase more and more digital currency assets, and I also decided to convert most of my assets into digital currencies. This includes not only some assets I originally had (savings, funds, stocks), but also my monthly fixed income thereafter.

Usually, I convert fiat assets into USDT through centralized exchanges, and then trade USDT for other cryptocurrencies, such as BTC, ETH... Finally, depending on the situation, I transfer currencies like BTC into my own wallet.

To diversify risks, I don't put all assets into one wallet to avoid losing all assets if this wallet's private key is leaked. For this reason, I created multiple wallets and keep the private keys of each wallet separately. (Currently, the mnemonic phrase of each wallet is stored in mnemonic phrase steel plates or capsules without isolation. That is to say, if the steel plate is lost, there is still a risk of leakage. In the future, I may consider splitting the mnemonic phrase for storage, for example, a 24-bit mnemonic phrase, divided into 3~4 copies, each storing 12~16 mnemonic words. In this way, even if one is lost, the wallet will not be leaked, and the wallet can be recovered through the other copies of mnemonic phrases)

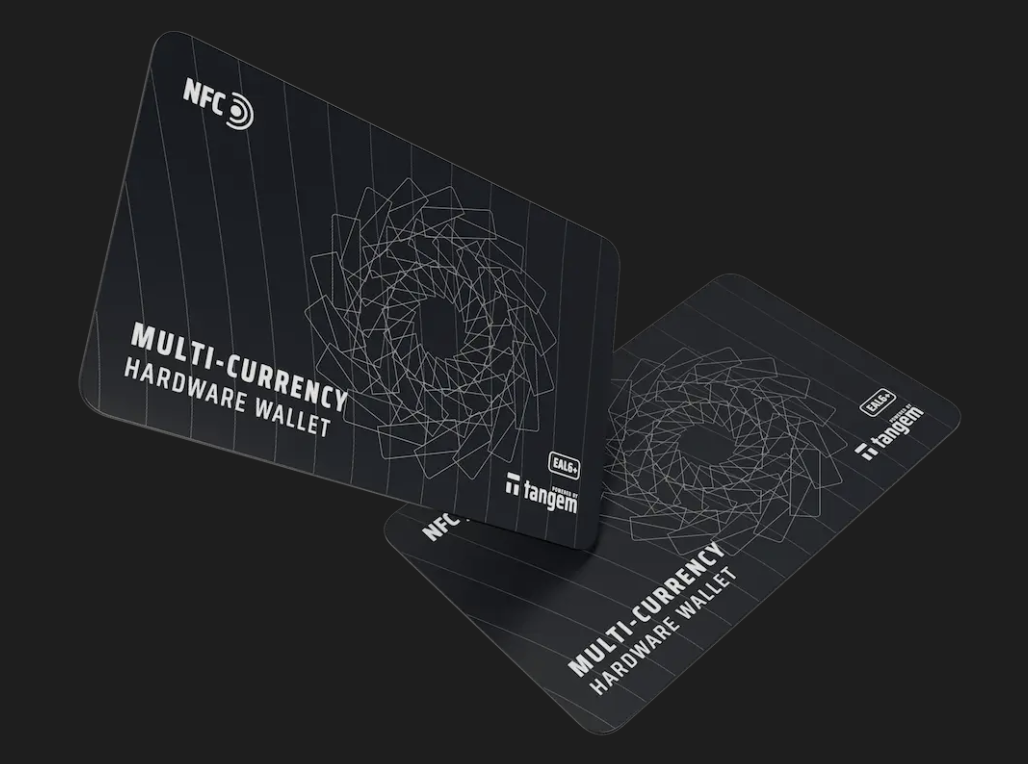

At the same time, for security reasons, I do not choose to store funds in software wallets (although they are very convenient to use). Wallets used for storing funds must be hardware wallets. Here I used ledger and tangem.

Ledger goes without saying, it is a very established hardware wallet brand. Regarding tangem, tangem is a card-style hardware wallet that stores sensitive information such as private keys in the card, and completes data signing through its app and NFC. Its advantage is that the private key is invisible to the user, so users don't need to worry about private key leakage. But also because of this problem, if the cards are all lost (it provides 2 backup cards by default), the user will lose this wallet forever. And the card needs to be used with tengem's app. If tengem runs away, there will also be a certain impact.

|

|

|---|---|

I divided these wallets into three types.

- Used for large storage of cryptocurrencies, and will not perform any interaction other than transfer operations.

- Used to store a portion of cryptocurrencies, and will connect to some well-known defi projects (such as uniswap, pancakeswap) for staking operations to earn a portion of income. Or purchase some nfts through platforms like opensea.

- Used to store a very small portion of cryptocurrencies. Specifically, there are relatively no restrictions on the use of this type of wallet. It can connect to some new projects for participating in new offerings or experiencing new features.

Given this split wallet management method, it brings security benefits, but also causes some trouble. My assets are scattered in various places, centralized exchanges, and n digital wallets. This makes asset statistics a very troublesome thing.

In the early days, I used some traditional asset statistics tools, such as Percento. They are powerful and can count not only cryptocurrencies, but even various assets such as bank accounts, stocks, etc., and can also achieve real-time updates on prices of various digital currencies and stocks. But they also have some disadvantages, for example, all cryptocurrency holding data needs to be entered manually.

Manually entering data seems very troublesome in my scenario. First of all, after buying digital currency with salary every month or after changing positions, I often need to manually update my various cryptocurrency assets, which costs me a lot of time. So I decided to update the quantity of each cryptocurrency only on a specific day each month, which also led to the data not necessarily being real-time. Plus I have many wallets, sometimes I even miss some assets during the statistics process, leading to data confusion.

Therefore, my ideal crypto asset statistics tool should be able to automatically read all cryptocurrency asset quantities and their real-time prices in these wallets just by entering wallet addresses or connecting to centralized exchanges. In addition, I also hope to see the changes in holding quantity of a certain digital currency, the proportion of all my digital currency holdings, as well as their ranking, total price and unit price changes, etc.

In this way, I can clearly see my asset details and holding changes at each stage. In addition, I also hope to be able to compare detailed data of two days, for example, I want to know what changes occurred in holding data on June 1 compared to May 1, which coins' prices rose, and which coins' holding quantities fell. This can help me analyze whether my position change decision is correct.

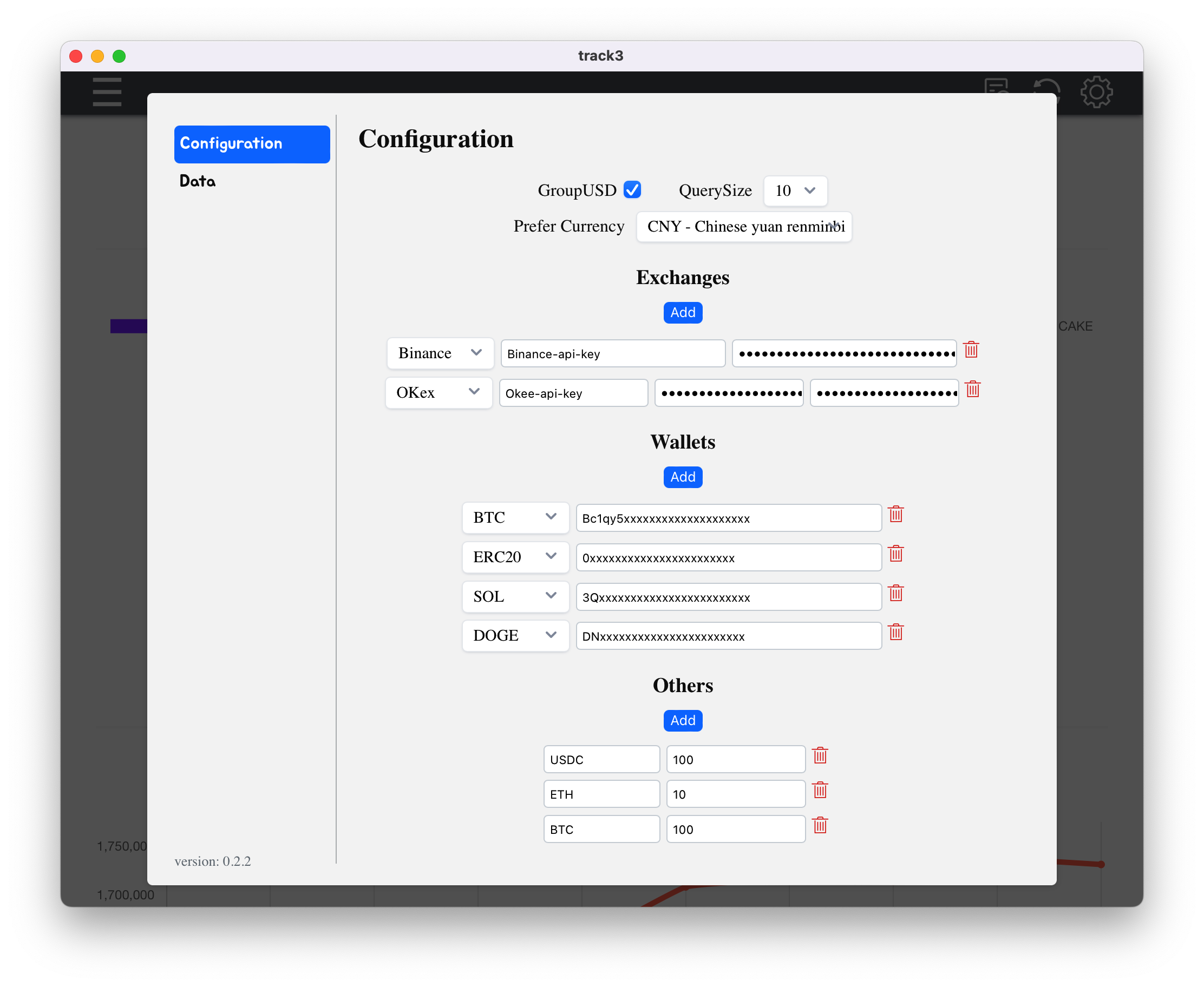

So based on these needs, I developed track3, a tool focused on crypto asset statistics. It currently supports asset statistics of several mainstream digital currencies, such as btc, erc20 token (eth, eth layer2, bnb and other evm compatible currencies), doge coin, sol, and supports two major mainstream centralized cryptocurrency exchanges binance and okex.

I can just input my wallet addresses, and api keys of various centralized cryptocurrency exchanges (read-only permission is enough).

Every time I open the app and click refresh, track3 will automatically read the quantity and price of all mainstream currencies (currencies that can be found on coingecko) in these exchanges or wallets, and analyze these assets.

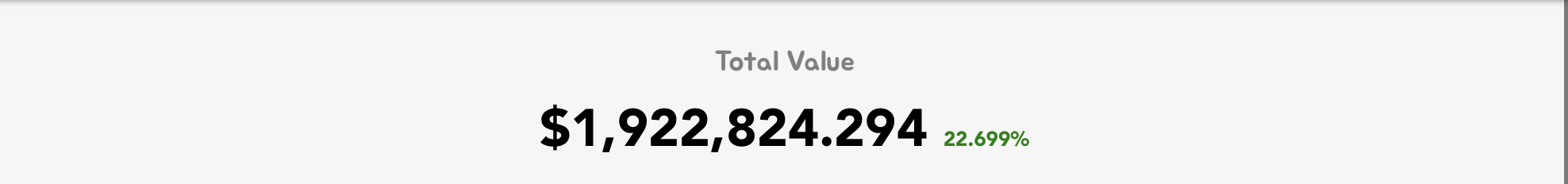

On the asset analysis function, I can see

- The fiat price of my current total assets (supporting 150+ mainstream fiat currencies such as usd, eur, cny)

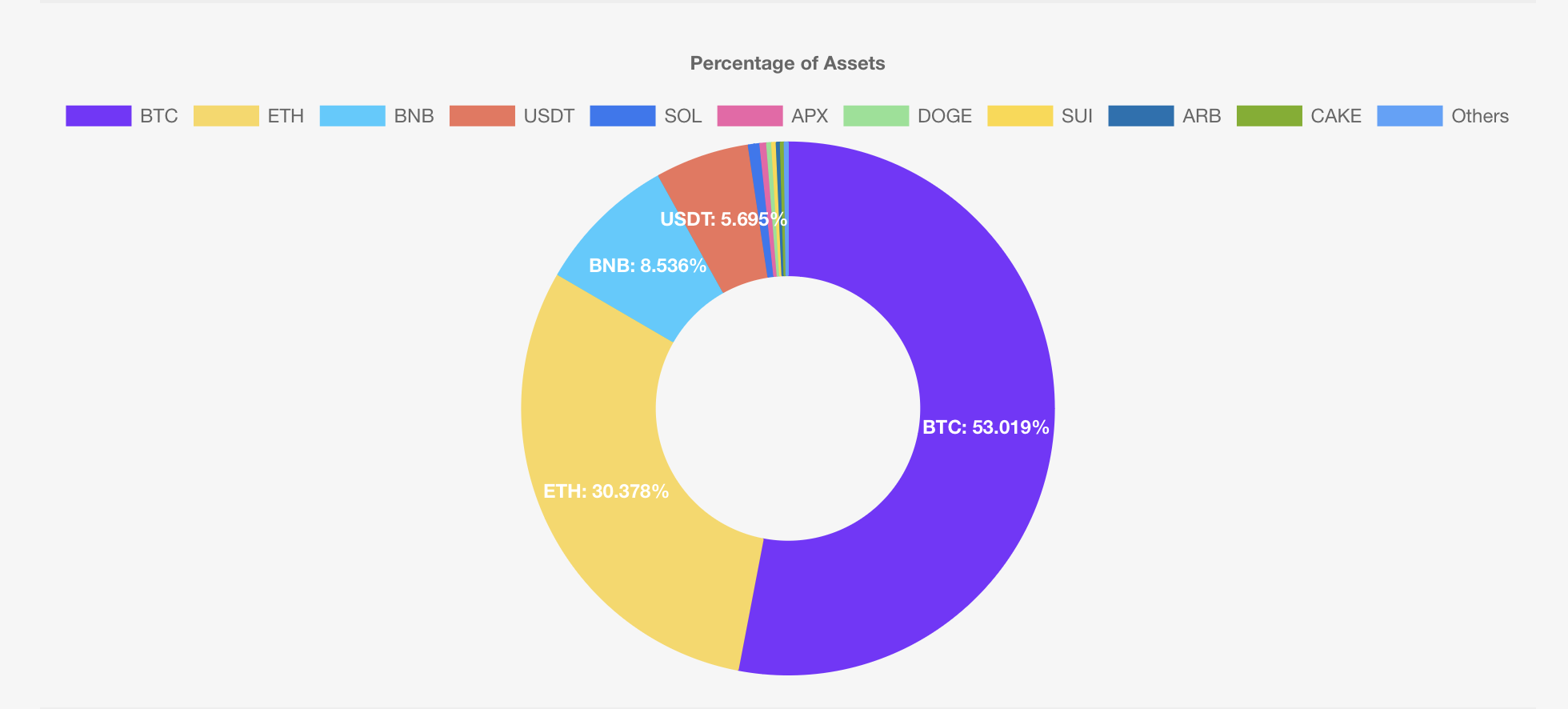

- The proportion of my top 10 currency holdings

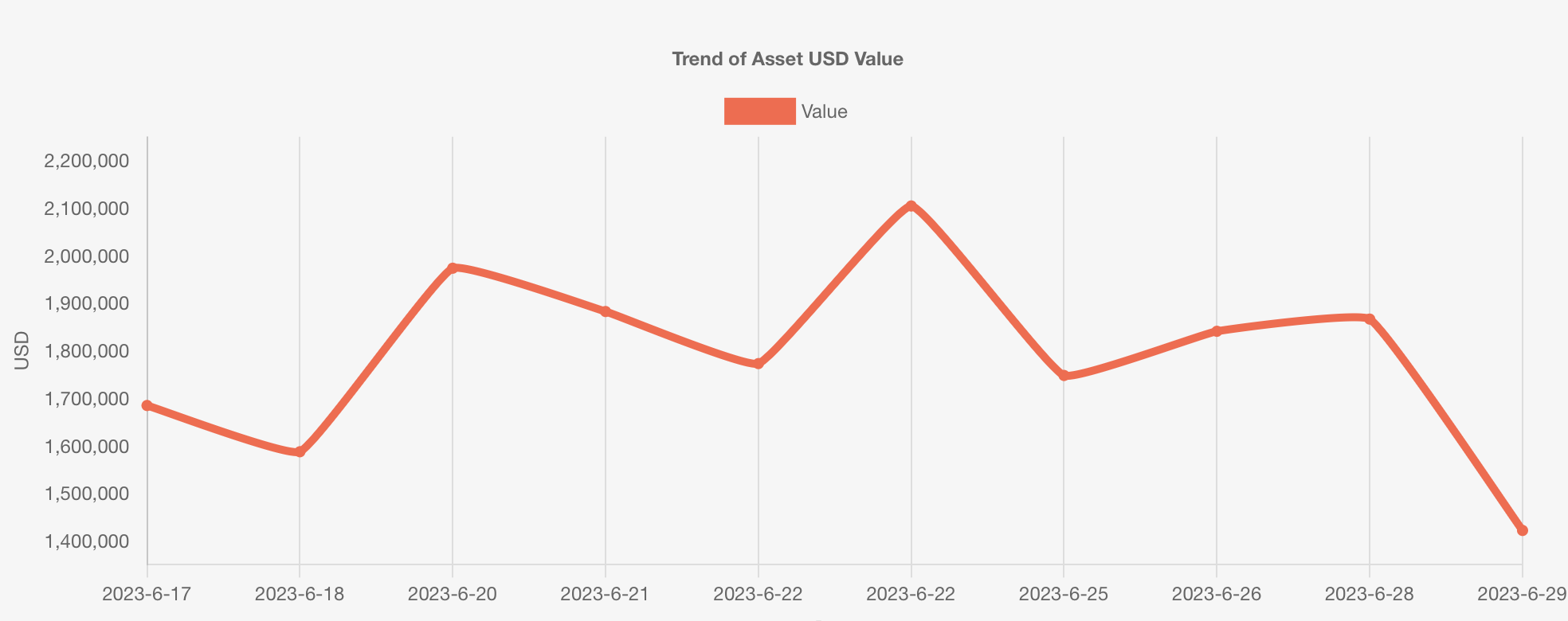

- The price change trend of my total assets

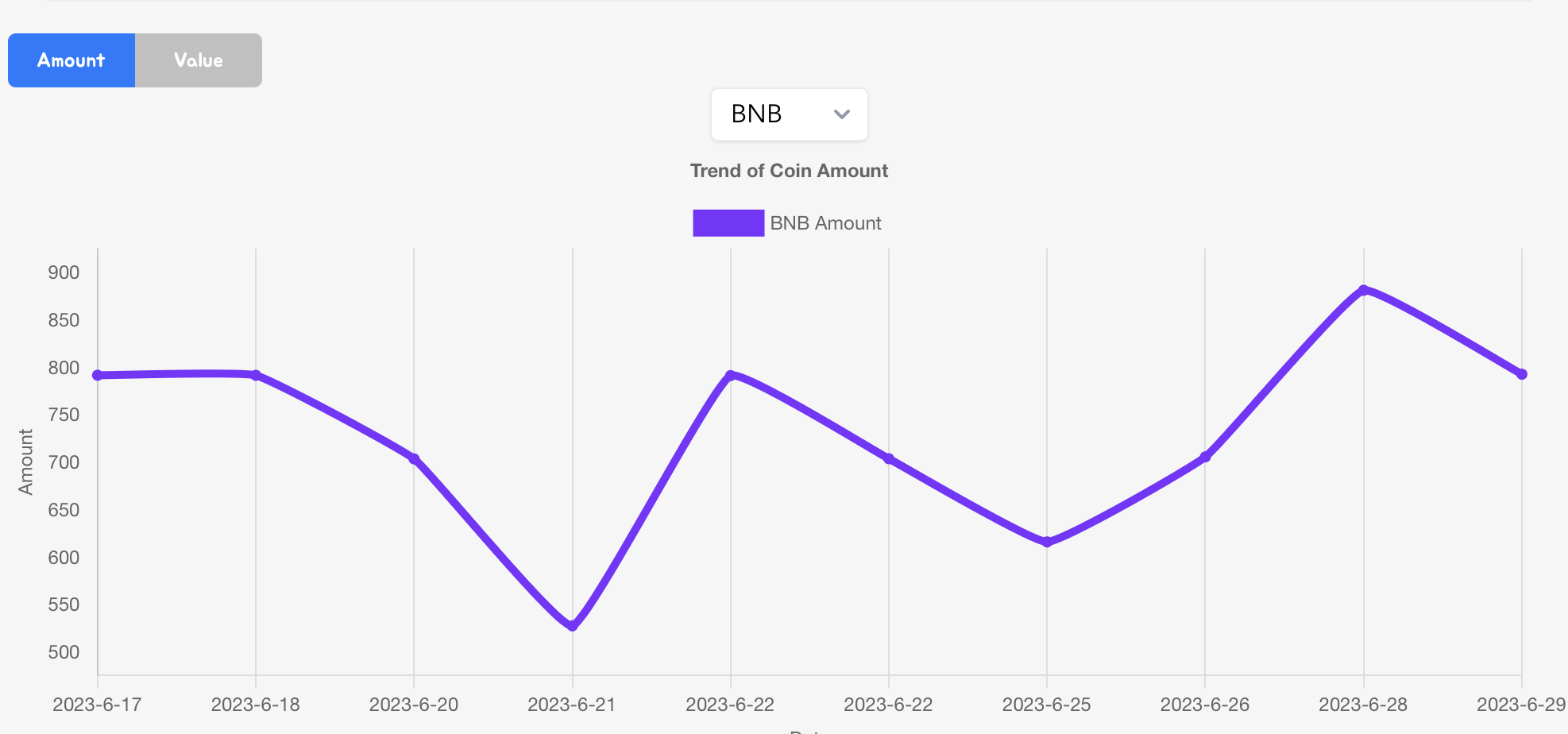

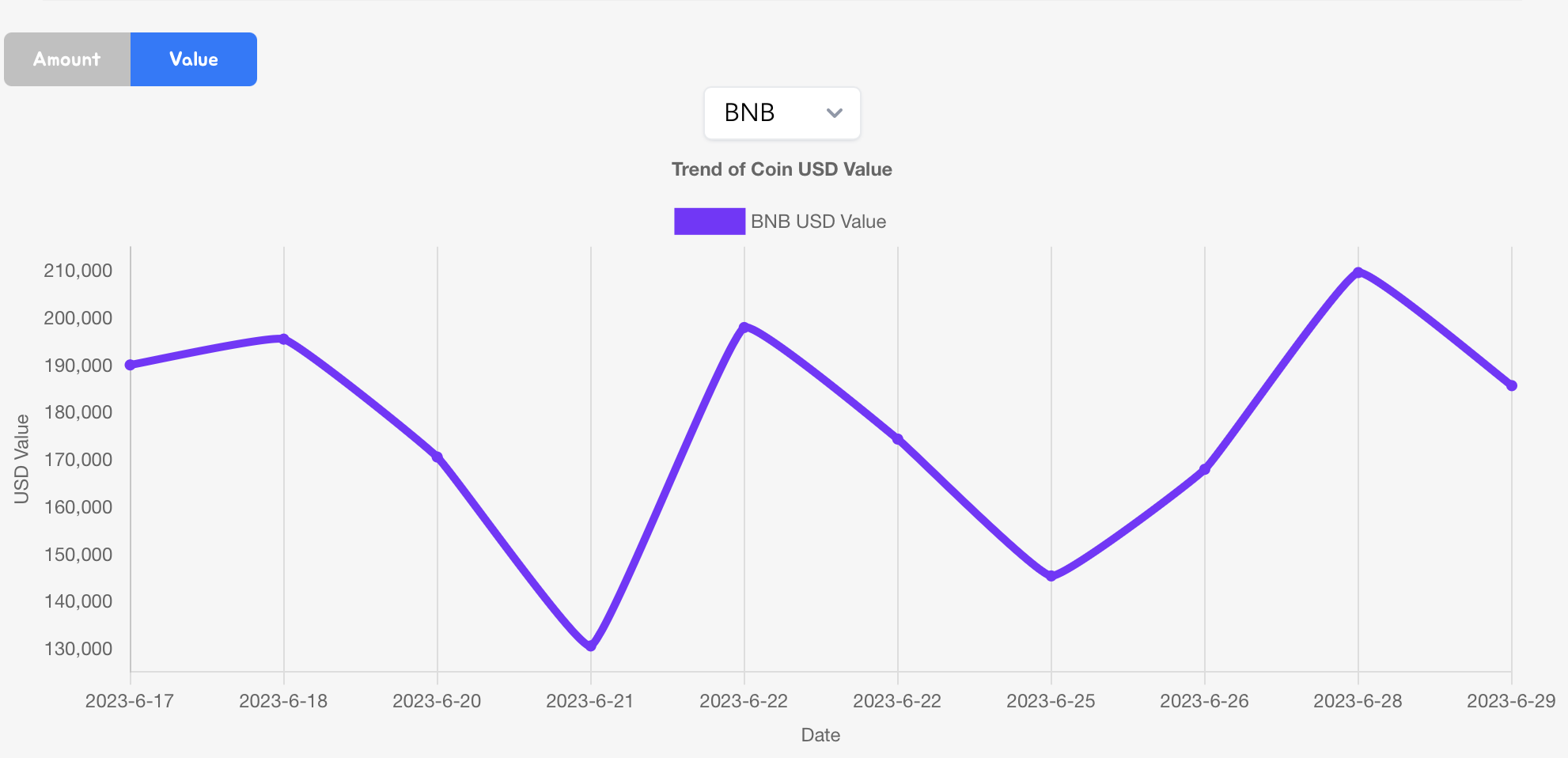

- The quantity of each of my currencies and its total price change trend

|

|

|---|---|

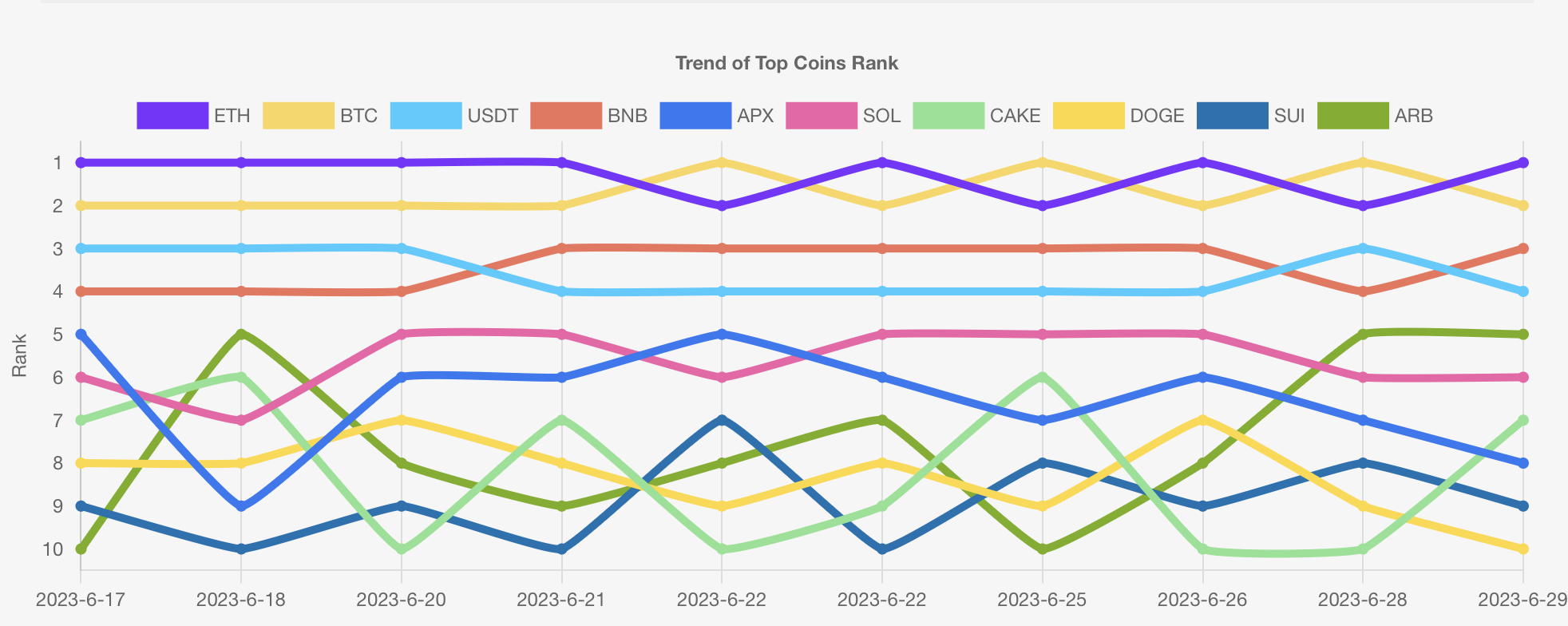

- Ranking changes of my top 10 currencies

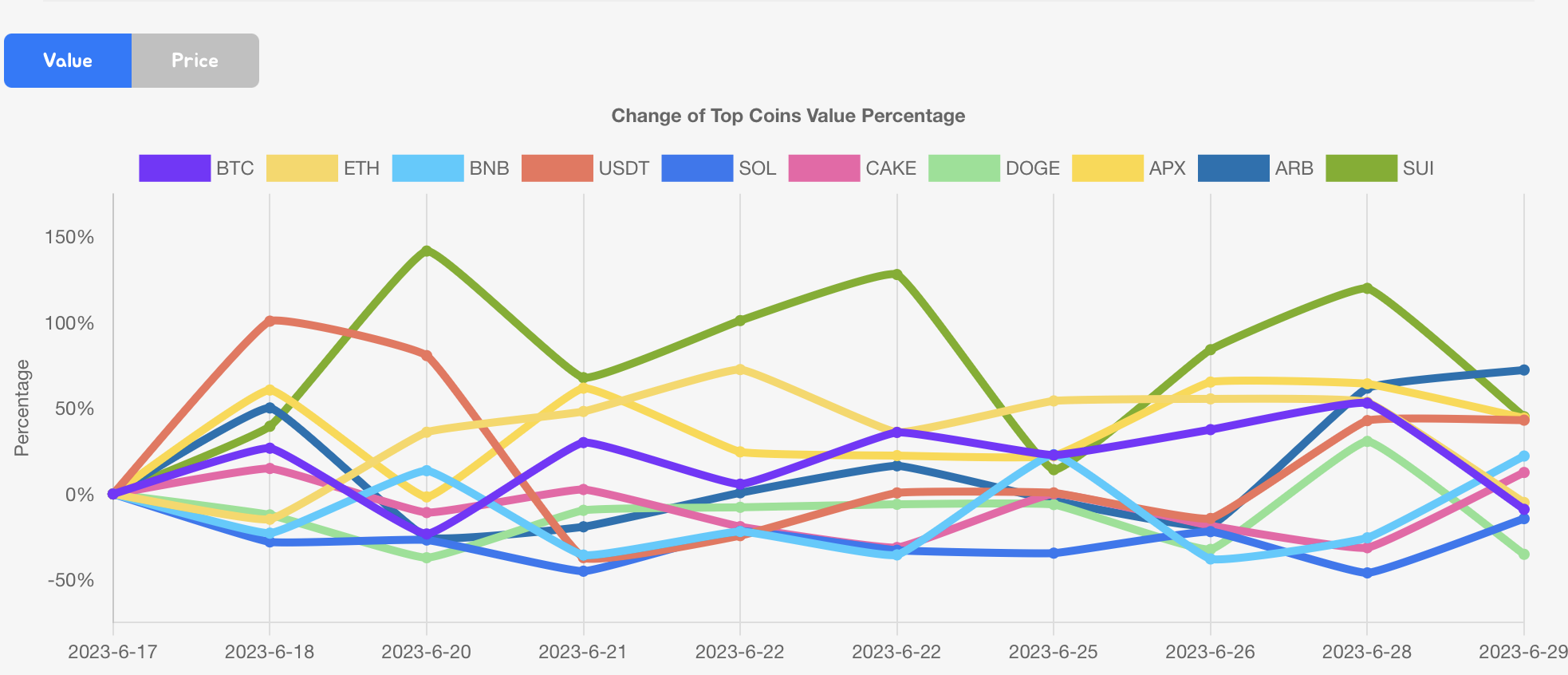

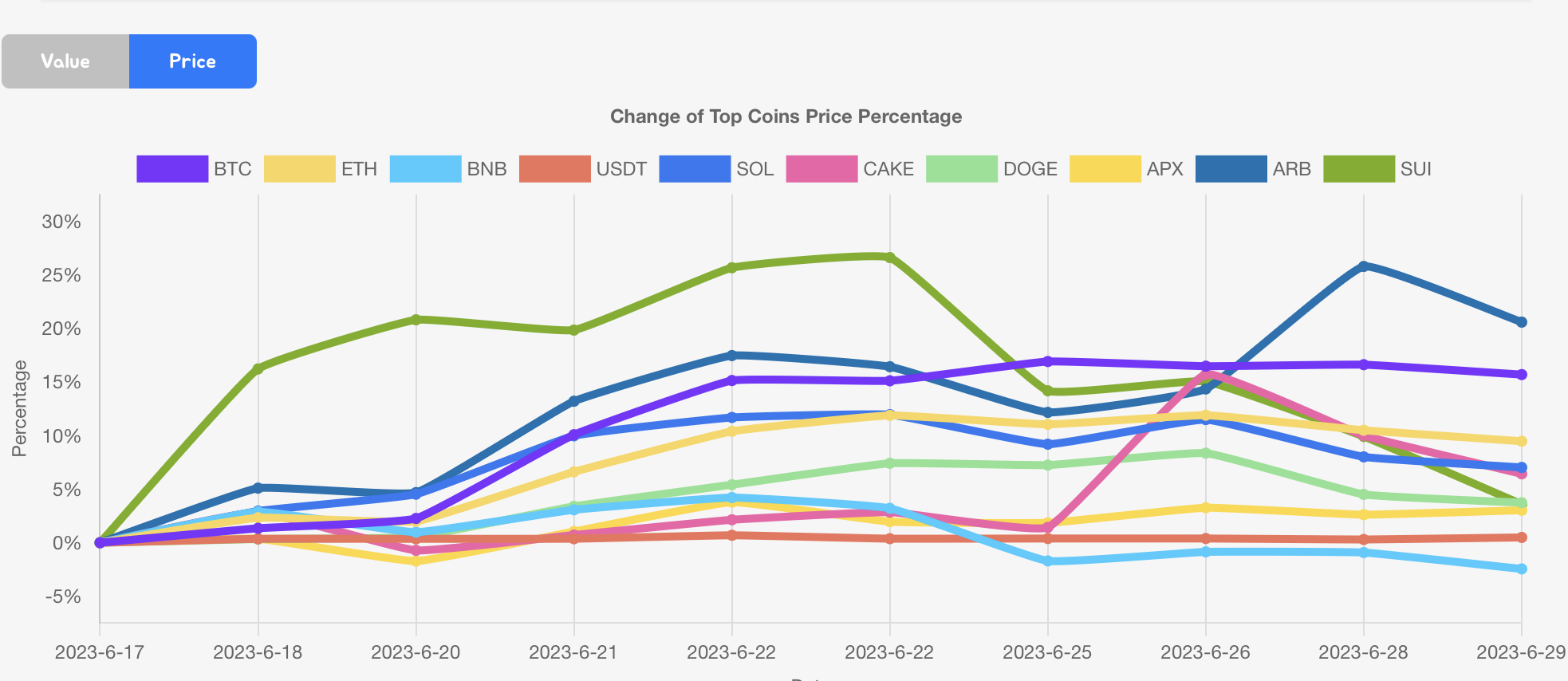

- The percentage change of total price and unit price of each of my currencies compared to its start date

|

|

|---|---|

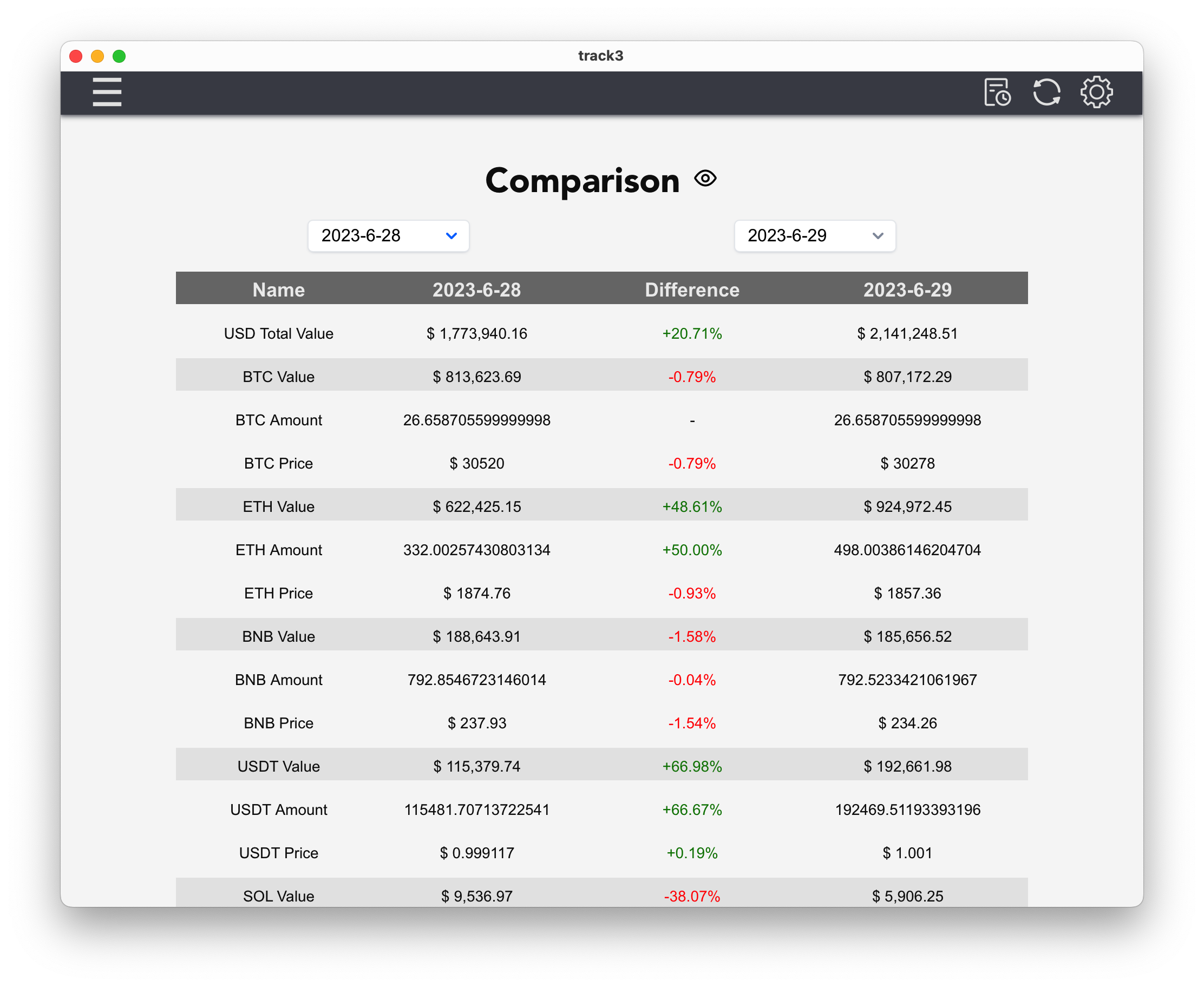

On the asset comparison function, I can see between two dates

- Comparison of total assets

- Comparison of total price, unit price and quantity of each currency

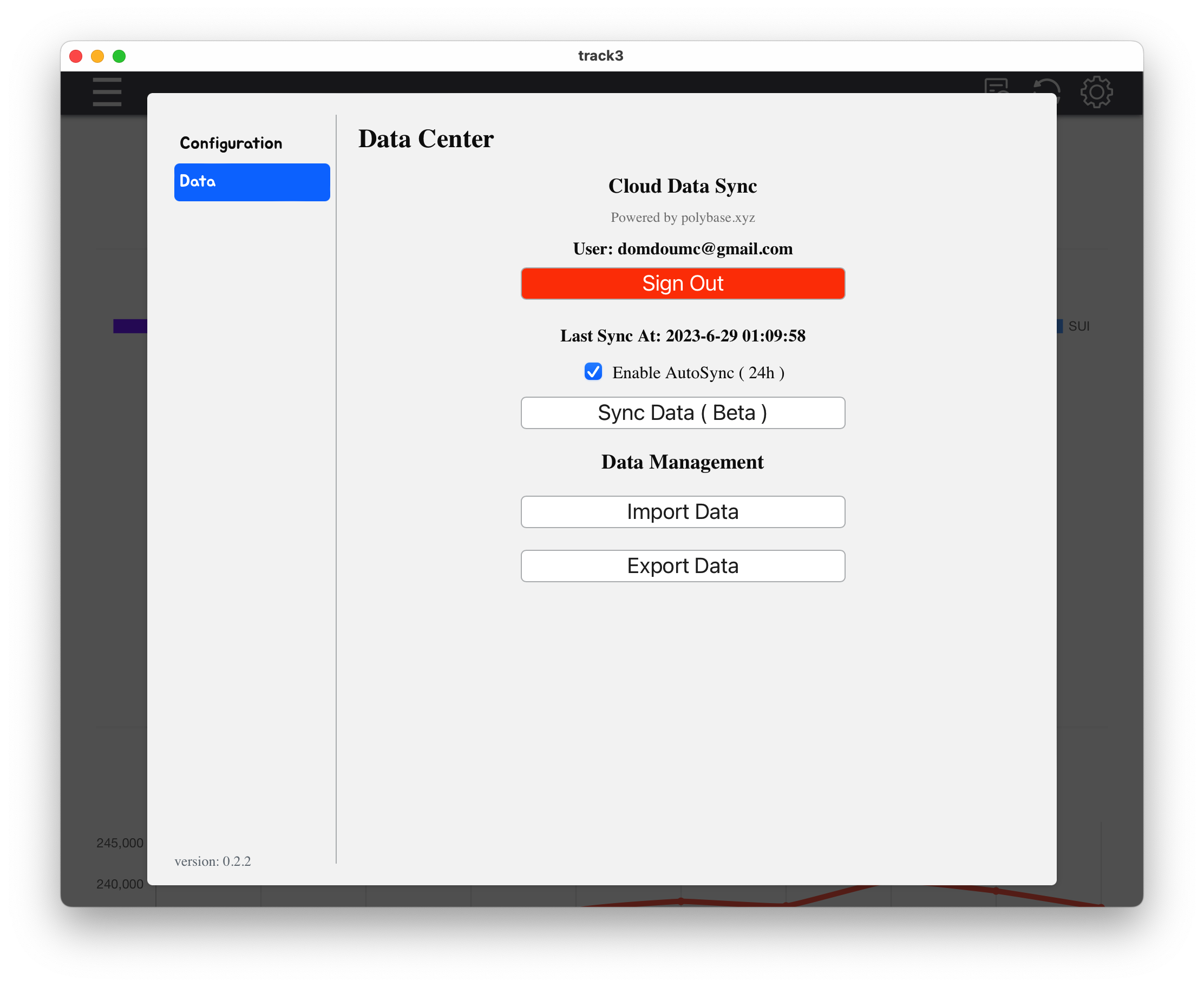

In addition, it also supports cloud synchronization, so I can use it back and forth between multiple devices without worrying about data unsynchronization. (If cloud synchronization function is not enabled, all data will only be stored locally forever)

But to ensure security, track3 will only synchronize asset data to the cloud. Therefore, there is no need to worry about the leakage of wallet addresses or exchange api keys, they will only be encrypted and saved locally forever. To ensure privacy, even asset data on the cloud cannot be viewed by anyone other than oneself. That is to say, even the admin of the cloud database cannot view user data. Being able to implement like this is because the cloud data synchronization function uses polybase.xyz as the database, which is a decentralized database. Interested friends can go to their official website to check function documents and learn more.

Because of the birth of track3, counting cryptocurrency assets has become extremely easy for me since then. I only need to click the refresh button when I want to check the latest data. After that, track3 automatically updates asset data in all wallets and exchanges for me. I also only need to configure the wallet address to track3 after creating a new wallet. No need to query assets in each wallet one by one, manually calculate the sum of their quantities, and enter them into the asset statistics system one by one as before.

If you have similar troubles, why not try using track3 to optimize cryptocurrency asset management.